Best Practices: Credit Card Payments

This article provides best practices for taking credit card payments, including online payments.

Link copiedCard-present transactionsLink copied

Card-present transactions include any transaction where a card is used in person (tap, insert, or swipe). Transactions where a card is used in person are less likely to be disputed than transactions where a card is not used in person.

Here are some best practices for card-present transactions:

Ask clients to tap or insert their card instead of swiping their card. EMV cards (chip cards) are more secure than cards without a chip.

Ask clients for a signature during checkout. Learn how to require a signature during checkout on your Front Desk Display.

Verify the client’s photo ID to confirm their name matches the name on the card being used.

Provide a receipt.

Link copiedCard-not-present transactionsLink copied

Card-not-present transactions include any transaction where a card is not used in person, including cards on file and online payments/deposits.

Here are some best practices for card-not-present transactions:

Use Express Booking™ to collect credit card information from clients when booking appointments. With Express Booking™, you can send a link to clients via text message where they must enter their information, add a credit card on file (if required), and accept your cancellation policy in order to complete a booking. As part of completing the booking, we collect the IP address, device model, and exact cancellation policy that was accepted. This information can later be used as evidence when fighting a dispute.

Verify the client’s photo ID on the day of the appointment to confirm their name matches the name on the card being used.

Link copiedLarge transactionsLink copied

We recommend that you collect the following documentation for any sale over $2,000. You can use the Forms app to collect digital forms.

Signed contract or purchase agreement: This document should include as many details about the sale as possible. The more details you include, the better equipped the Mangomint team is to help you if a dispute occurs.

Signed credit card authorization form: This form should include the total amount to be paid.

Copy of the client’s ID: This will confirm that the client’s name matches the name on the card being used.

For security purposes, if you complete a large transaction, the Mangomint team may contact you to request documentation.

Link copiedCancellation policyLink copied

We recommend that you cover returns, exchanges, and refunds in your cancellation policy, including a clear timeframe for when they can be done. If clients will be charged for no-shows or cancellations, make sure that is clearly stated in your cancellation policy. Learn more about creating a cancellation policy and adding it to Mangomint.

Link copiedReceiptsLink copied

We recommend that you include the following information on your receipts:

Your contact information, including your address, email, and phone number. This helps increase the chance that clients will contact you directly if there is an issue rather than contacting their bank to file a dispute. To manage your contact information included on your receipts, open the Settings app and select Business Setup > Locations. Learn more about sending and printing receipts.

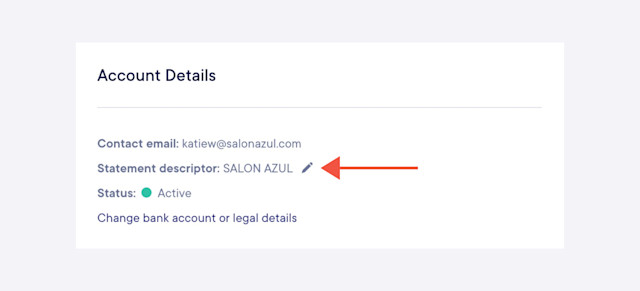

A recognizable business name and description of services/goods sold. This helps clients recognize your business name on their bank statements and identify the exact services/goods purchased. To update your business name that displays on a client’s bank statement, open the Settings app. Select Payments & Checkout > Payment Accounts > Manage account and update your Statement descriptor.

Link copiedProtecting your revenue from fraudLink copied

To learn more about common types of fraud, including red flags to watch out for, visit our blog.

For example, online sales of gift cards, memberships, and packages, while convenient, can open up your business to potential fraudulent activity. This is a universal reality for any platform that processes online payments.

Here are some ways you can help protect your revenue from fraud:

Enable internal notifications for online sales: Enable internal automated notifications for online gift card, membership, and package sales. These notifications will let you know if a client's billing address could not be verified, which could indicate increased fraud risk.

Refund to the original payment method: When completing refunds, we recommend refunding to the client's original payment method to help minimize the risk of a dispute.

Verify client information: For in-person sales, verify a client’s photo ID to confirm their name matches the name on the card being used.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.